Essential Guide to FMCSA Insurance and Licensing for New Trucking Companies

Are you looking for insurance and licensing for your trucking business? This guide outlines the essential insurance requirements and steps to get licensed. For businesses operating commercial vehicles, it is crucial to comply with FMCSA regulations and ensure adequate commercial auto insurance. Understanding FMCSA insurance requirements is especially important for new trucking companies that operate for-hire, as compliance with insurance mandates is essential for transporting goods or passengers for compensation, particularly when crossing state lines.

Key Takeaways

- New trucking companies must secure FMCSA-required insurance, including a minimum of $750,000 in Auto Liability coverage for non-hazardous cargo and $1,000,000 for hazardous materials.

- The FMCSA licensing process involves applying for operating authority through the Unified Registration System and requires timely submission of necessary forms, including BMC-91 or BMC-91X.

- Maintaining compliance with FMCSA regulations is crucial, as non-compliance can lead to hefty fines and loss of operating authority, highlighting the need for regular audits and insurance monitoring.

Key FMCSA Insurance Requirements for Motor Carriers

Securing the right necessary insurance is crucial for any new trucking company. FMCSA insurance requirements ensure motor carriers maintain financial responsibility, protecting both the public and the carriers. Central to these requirements are liability and cargo insurance, offering necessary legal and financial protection. For instance, carriers transporting non-hazardous freight must have a minimum insurance requirements of $750,000 in Auto Liability coverage, while those hauling hazardous materials need at least $1,000,000 in coverage. Additionally, FMCSA insurance requirements also include ensuring driver qualifications to maintain safety standards.

Both interstate and intrastate carriers must comply with specific insurance and regulatory requirements to gain operating authority from the FMCSA. These regulations differ based on the type of carrier, making it essential to file the correct insurance and legal documentation.

Recognizing the specific risks tied to various trucking operations and cargo, including transporting hazardous materials, is vital. Regularly updating and monitoring your insurance filings helps protect compliance with carrier safety administration fmcsa guidelines and prevents legal issues.

The following subsections will explore the key forms and endorsements that FMCSA requires for required forms to keep your operations compliant.

BMC-91/BMC-91X Forms Explained

The specific forms BMC-91 and BMC-91X are crucial for FMCSA compliance. These forms confirm that your Auto Liability coverage meets FMCSA’s standards, proving your trucking company is financially responsible and adequately insured, a cornerstone of operational legitimacy.

When your insurance company files these forms, it bridges the gap between meeting insurance requirements and obtaining operational approval from the FMCSA. Without them, your application for interstate operating authority can falter, delaying your entry into the trucking industry and making it difficult to cross state lines.

The Role of MCS-90 Endorsement in Protecting the Public

The MCS-90 endorsement acts as a financial guarantee for legal liabilities, protecting the public. While not a replacement for Auto Liability insurance, the MCS-90 ensures your insurance company will cover any legal liabilities your trucking company incurs.

This endorsement is mandatory under FMCSA guidelines, reinforcing the financial responsibility required from all motor carriers. It provides vital assurance for environmental restoration and public safety, ensuring funds are available for accidents or other liabilities, in accordance with federal motor carrier safety.

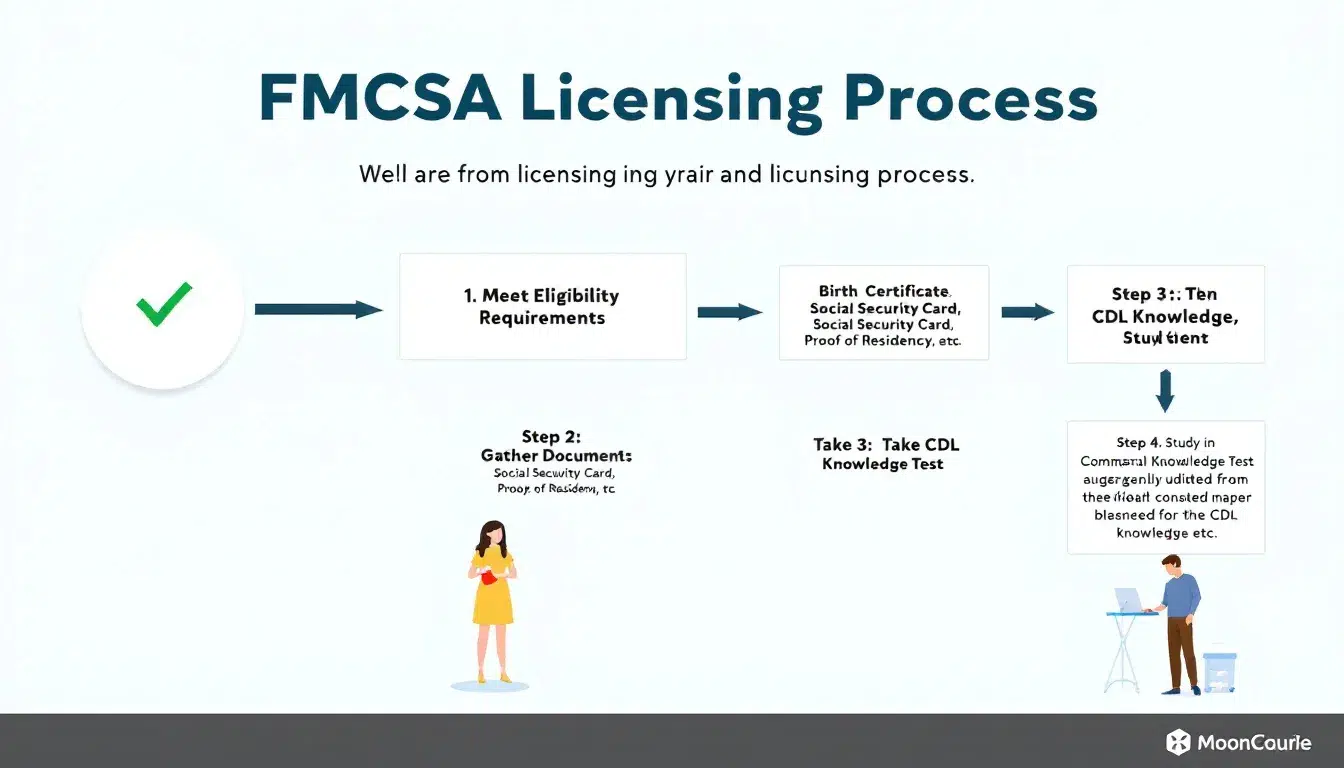

Navigating FMCSA Licensing Process

The FMCSA licensing process can seem daunting, but understanding the steps involved helps. First-time applicants must use the Unified Registration System (URS) to apply for operating authority by submitting the MCS-150 series form and OP-1 form, which includes a $300 fee.

After submitting these forms, ensure your insurance filings, such as the BMC-91 or BMC-91X, are in place to pay for these steps, which are crucial for obtaining your operating authority and starting as a compliant motor carrier broker agency. Making a down payment is essential to ensure compliance and timely submission of proof of insurance. You must submit these documents promptly.

The following subsections will break down the process of applying for and activating your MC Number, a key component of FMCSA licensing.

How to Apply for an MC Number

Applying for an MC Number is a vital step in the FMCSA licensing process. Start by providing a government-issued ID as part of your documentation. Your insurance company will then file the necessary BMC-91 or BMC-91X forms on your behalf.

These forms, essential for activating your MC Number, must be submitted correctly to expedite the process and avoid delays in gaining operating authority.

Activating Your MC Number: What You Need to Know

After applying for your MC Number, you need to activate it to start operations. The MC Number updates daily at 5 am, so check its status regularly. The FMCSA’s Licensing and Insurance page is useful for monitoring your MC Number status.

Regularly checking your MC Number status helps maintain compliance with FMCSA requirements and prevents operational issues. This proactive approach allows you to address discrepancies promptly, ensuring smooth business operations.

Finding the Right Commercial Truck Insurance

Selecting the right commercial truck insurance and commercial auto insurance is essential for meeting FMCSA standards and protecting your business. The FMCSA mandates different insurance levels based on the entity type and operating authority for commercial motor vehicles. Evaluate coverage for liability, cargo, and physical damage to ensure comprehensive protection. It is crucial to select a knowledgeable insurance provider for transportation companies, as the right provider can help navigate the specific insurance needs pertinent to the trucking industry.

Failing to meet FMCSA insurance requirements can result in increased premiums and other financial burdens. Choose an insurance company that understands the specific insurance requirements of the trucking industry and provides coverages aligning with FMCSA standards. Insurance companies that specialize in this area can offer tailored solutions.

Differences Between Auto Liability and General Liability Insurance

Knowing the differences between auto liability and general liability insurance is key to selecting the right coverage. Auto liability insurance covers damages from vehicle-related incidents, ensuring financial responsibility for accidents where your driver is at fault. This insurance is mandatory for all trucking companies and is a critical component of FMCSA compliance.

General liability insurance, however, protects against a broader range of risks, such as property damage and bodily injury unrelated to vehicle operation. It covers incidents related to your business premises and employee actions, offering comprehensive protection beyond motor vehicle operations, including public liability insurance.

Importance of Cargo Insurance for Motor Carriers

Cargo insurance is a vital component of a motor carrier’s insurance portfolio. It mitigates financial losses from damage or theft of goods during transit, protecting against various shipping-related risks. This coverage ensures your business can recover from unexpected incidents during transport household goods and vehicles.

Cargo insurance offers trucking companies a safety net against potential liabilities and financial losses from damage or theft of cargo. Securing this insurance allows you to operate with peace of mind, knowing your cargo is protected against unforeseen events.

Maintaining Compliance with FMCSA Regulations

Maintaining compliance with FMCSA regulations is crucial for legal operation. Regularly updating and monitoring your insurance filings keeps you in good standing with the FMCSA. Companies must keep proof of insurance on file to avoid registration revocation.

Regular audits ensure ongoing compliance, helping identify and rectify issues before they lead to legal problems. Staying compliant protects your business and contributes to the trucking industry’s overall safety and reliability.

How to Monitor Your MC Number Status

Monitoring your MC Number status is essential for maintaining compliance with FMCSA regulations. The FMCSA offers an online platform where motor carriers can check their MC Number status and compliance information. The SAFER website allows you to track your status using various identifiers.

Regularly monitoring your MC Number status ensures compliance with FMCSA requirements, avoiding operational issues and penalties. This proactive approach is essential for smooth business operation.

Consequences of Non-Compliance

Non-compliance with FMCSA regulations can have severe consequences, including hefty fines and potential loss of operating authority. The FMCSA takes these regulations seriously, and failure to comply can lead to significant financial penalties, legal fees, and operational restrictions.

Non-compliance can also lead to civil lawsuits for negligence, compounding costs and risks. Ensuring compliance with FMCSA regulations is not just a legal requirement, but a critical aspect of protecting your business from severe consequences.

Need Help with FMCSA Insurance and Licensing? Focused Compliance Group Can Help

At Focused Compliance Group, we understand that navigating the FMCSA’s insurance and licensing requirements can be one of the most confusing and time-consuming parts of starting or maintaining a compliant trucking operation. That’s why, in addition to our core safety and compliance services, we offer expert guidance and support in securing FMCSA-approved insurance coverage and completing licensing steps for brokers—ensuring you’re fully prepared from day one.

Whether you’re a new entrant carrier or an established company looking to update your coverage, our team is here to walk you through the entire process with ease and accuracy.

How Focused Compliance Group Assists You

We’re not an insurance broker—but we partner with FMCSA-approved insurance providers who specialize in commercial trucking. Our team can help you:

- Evaluate your coverage needs based on your cargo, equipment, and authority type

- Connect you with trusted insurance providers that understand FMCSA requirements

- Ensure BMC-91/BMC-91X filings and MCS-90 endorsements are submitted correctly

- Provide education on the difference between Auto Liability, General Liability, and Cargo Insurance

- Assist with filing your MCS-150, OP-1 forms, and activating your MC Number

- Help you track and monitor your MC Number status via the FMCSA Licensing and Insurance system

- Offer ongoing compliance monitoring, so your filings remain current and audit-ready

We also understand the regulatory requirements and financial obligations of freight brokers, including the differences between BMC-84 and BMC-85 forms, which impact surety bonds and trust funds.

This service is especially valuable for new carriers trying to get their business on the road quickly while avoiding costly delays caused by incomplete paperwork or filing errors.

Compliance Isn’t Just About Paperwork—It’s About Protection

We often see new carriers underestimate the importance of insurance filings until it’s too late—either their authority is delayed, or they face compliance issues during an FMCSA audit. At Focused Compliance Group, we proactively help you avoid these pitfalls. Our goal is to provide you with the knowledge, connections, and support you need to meet every FMCSA regulation—not just the ones related to safety, but those tied to financial responsibility and licensing as well.

We offer turnkey compliance packages that incorporate insurance verification, licensing support, and audit readiness, so you’re not scrambling to figure things out after the fact. Additionally, we help you understand the other costs related to claims and legal protections that businesses may incur.

Let Us Help You Get Compliant—and Stay Compliant

If you’re a new motor carrier or broker agency trying to figure out your insurance and licensing responsibilities, don’t go it alone. The process can be complex, and small mistakes can delay your operations or result in compliance penalties. The motor carrier safety administration establishes mandatory insurance requirements for trucking companies to ensure financial responsibility and operational authority.